Community Message

from our President/CEO, Ken Johnson

Recent bank closures and the consequences for its customers have certainly caused the industry to look inward. It’s imperative that all financial institutions acknowledge their vulnerabilities in different market situations. It’s equally important to look outward, from the perspective of our depositors, to ensure we’ve presented a fortress for their deposits and investments. With that said, it’s important to recognize that the recent closures were very unique in a number of ways and not indicative of the banking industry as a whole.

North Shore Bank has been serving the Duluth, Superior, and surrounding communities for approximately 108 years. We, like most community banks, closely monitor our asset and liability composition and interest rate sensitivity. By understanding our well-diversified mix of customers, North Shore Bank is able to mitigate interest rate risk, cash flow risk, and keep the Bank’s financial position strong while keeping our customers' assets safe. North Shore Bank has a history of being a well-capitalized community bank and continues to be based on current regulatory capital standards. We continue to hold a diversified deposit composition made up of local deposits from within the Duluth, Superior, and surrounding area coupled with a variety of available financial institutional funding sources. North Shore does not invest, trade, hold or lend against, or make loans collateralized by digital assets.

We take pride in our relationship-based business model focused on building long-term trust with our customers and would like to share a few bullet points regarding the community banking industry:

- Community banks remain well capitalized and well positioned to continue to serve our customers and community.

- Community banks have always been focused on safety and soundness as part of our traditional and relationship-based business model.

- This unique banker access is what makes community banks different and an asset to those they serve. Customers often know the President/CEO of a community bank and can reach out with questions or concerns.

If you have questions about your coverage, or would like to learn more about FDIC insurance and how it works, we encourage you to access the following resources, or give us a call directly at 218-722-4784.

FDIC Calculator: https://northshore.bank/bank/tools-and-resources/additional-resources

Thank you for choosing North Shore Bank!

Enjoy a new, convenient way to pay!

Tap-to-pay…and be on your way!

As of May 1, all new or reissued North Shore Bank Debit Cards will include the contactless feature. Once you receive your new debit card in the mail, activate your card to utilize simple tap-to-pay processing at contactless terminals. Your card will work at all types of checkouts, so you will be able to use it anywhere Mastercard® is accepted.

How do you use your card?

- Look – Find the contactless symbol at checkout

- Tap – Simply tap your contactless debit card on the checkout terminal

- Go – your payment is processed in seconds!

Why is this a good thing?

- Easy – Simply tap your card on the checkout terminal

- Secure – Same dynamic security as our regular chip cards

- Fast – Payments are processed in seconds

Get the most out of your card!

- Bill payments & subscriptions – update your account and add your new card to all of your recurring monthly bill payments and subscriptions.

What’s in it for me?

- Get cash or check balances at ATMs that accept Mastercard® worldwide

- Use any North Shore Bank ATM or any of the thousands of MoneyPass® ATM's throughout the country (including over 2,000 Walmart stores) without being charged a transaction fee

- Enjoy the extra security of Mastercard’s Zero Liability Protection*

- Automatically helps protect you from unauthorized charges since funds that are taken from your account due to fraudulent use will be returned to your card

- Mastercard’s ID Theft Protection™ comes with your card

- Sign-up for added peace of mind at mastercardus.idprotectiononline.com**

- Control your card from your smartphone and make your life easier!

Check out the extra benefits!

- Streamlined service - Funds are deducted from your checking account like normal, but with the added security of a Mastercard®

- Stress-free use – Contactless cards work at all types of check terminals, not just tap-to-pay ones. You can simply insert or swipe your card as you have in the past.

Let’s get you started!

- To request a new card, simply call us at 218-722-4784 during normal business hours (Monday through Friday between 8:30am - 5:00pm CST), or stop into your nearest branch.

Thank you for choosing North Shore Bank. We appreciate you, and are happy to serve your financial needs.

*For specific restrictions, limitations, and other details, see your card agreement or contact North Shore Bank

**Sign-up required by visiting mastercardus.idprotectiononline.com to register

***Mastercard® is a registered trademark of Mastercard International Incorporated

Lobbies reopening February 8, 2021!

We are pleased to announce that our lobbies will reopen on Monday, February 8, 2021. We look forward to seeing you in person again! We continue to have our COVID-19 protocols in place to protect our customers and employees, including a requirement to wear masks. We appreciate your understanding and we look forward to serving you in person next week!

When you visit our lobbies, you can expect to see the following:- Plastic shields have been installed where necessary.

- Markers are provided to assist in maintaining a social distance of 6 feet.

- Hand sanitizer stations are in place for your convenience.

- Masks are required and available for your use. We may ask you to lower your mask briefly for identification purposes.

COVID-19 Lobby Access Update

North Shore Bank is committed to the health and well-being of our customers, employees and the community as we continue to navigate concerns surrounding the COVID-19 pandemic.

| Mortgage Lending | (218) 722-5966 |

| Deposit and Consumer Banking | (218) 722-4784 |

| Safe Deposit Box Access | (218) 722-4784 |

| Business Banking and Lending | (218) 733-5569 |

| Trust and Private Banking | (218) 722-4211 |

| Insurance Services | (218) 625-1256 |

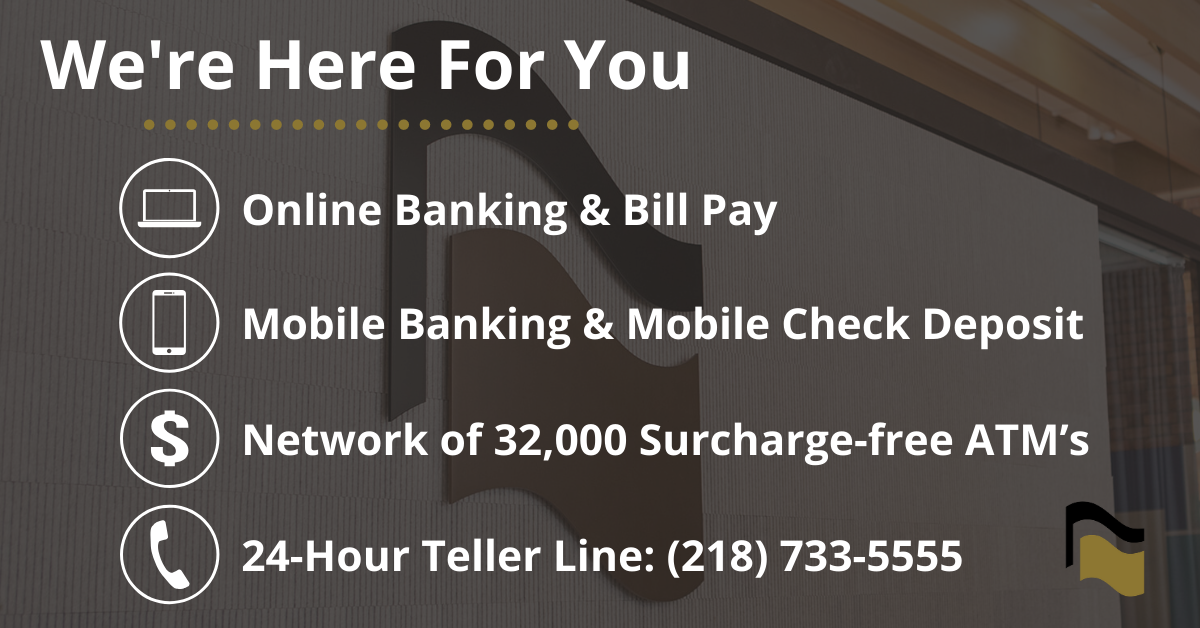

North Shore Bank offers a variety of additional ways to access your accounts. We encourage you to take advantage of our online and mobile banking services, available 24 hours a day, 7 days a week, designed to give you more convenience in managing your finances.

We will continue to monitor the COVID-19 situation closely and will take the necessary precautions to help keep everyone safe, while continuing to provide you with the service and support you expect from us.

2nd Avenue West Entrance - Temporary Closure

Beginning Monday, July 13, our 2nd Avenue West entrance will be temporarily closed due to the Superior Street reconstruction project. Access to the Bank will remain available via the Superior Street entrance, or through the skywalk system. The Auto Bank also remains open and accessible for all business.

Customer parking spaces are available in the Auto Bank parking lot and you may access the Bank via the following routes:

- Take the 2nd Ave W. sidewalk on the Holiday Inn side of the street, cross the avenue on Superior Street and enter through the Superior Street entrance.

- Walk up to First Street and enter through the Holiday Inn and access the Bank via the skywalk.

In addition to the Auto Bank parking spots, the following ramps are offering free parking if you enter and leave within an hour:

- Civic Center Ramp—410 West First Street

- Tech Village Ramp—10 East First Street

- Duluth Transportation Center—228 West Michigan Street

- 4th Avenue Auto Park—402 West Michigan Street

- Hart District Ramp—125 East Superior Street

- Medical District Ramp—302 East First Street

We apologize for any inconvenience. We will keep you updated on access to the Bank as the renovation project continues. We look forward to seeing the final transformation!

North Shore Bank Branch Access Plan

We would like to thank our customers for their continued loyalty and patience during the unprecedented COVID-19 pandemic. Our management team has worked quickly to adapt our working environment to protect our customers, employees and the community, while providing you with the services you expect.

COVID-19 Operational Update

At North Shore Bank, serving our community’s financial needs while protecting the health and safety of our employees and customers is our top priority. We understand how important it is to provide uninterrupted service to our customers, and though the delivery methods of our services have adjusted to limit face-to-face interactions, we continue to meet customer financial needs, and our customers have experienced some improved efficiencies through electronic delivery.

Financial institutions are considered an essential service under MN Governor Walz’s stay-at-home order and federal guidelines. North Shore Bank has implemented plans to protect the health and safety of our employees and customers. As of March 19th, our lobbies were closed to public access. Many employees are working from home, and those in the offices have been spread out to achieve social distancing measures. We continue to provide excellent service through our drive-up locations, online and mobile banking, in-person meetings by appointment if necessary, and by phone.

North Shore Bank to Facilitate Loans Through the Paycheck Protection Program

At North Shore Bank, we know your small business is important to you, and is equally as important to our community!

As an SBA lender, North Shore Bank is able to help facilitate your Small Business Administration loans through the recently passed Coronavirus Aid, Relief, and Economic Security (CARES) Act Paycheck Protection Program.

Learn More

COVID-19 Update: From President/CEO, Ken Johnson

Despite the current healthcare crisis we want to assure you the banking industry remains stronger than ever, and therefore banks continue to be the safest place to keep your money.

Coronavirus Scams - What to Look For, and How to Protect Yourself

Rick Haney, ERM Officer, Vice President

3/26/2020

As expected, cyber-criminals have been actively expanding their repertoire of scams to take advantage of coronavirus disruptions. These scams play off of people’s anxiety and fear and target anyone and everyone with identity theft and fraud schemes and may include malware device and system attacks. The more people they reach, the better. Some of the most recent scams are centered on the proposed USA stimulus checks, COVID-19 vaccines/cures and tech support.

COVID-19 Update: From President/CEO, Ken Johnson

Important Notice Regarding COVID-19

Effective Thursday, March 19th, and until further notice, all North Shore Bank lobbies will be closed. Our Drive-Up’s will remain open during normal business hours to serve you, or you can visit our ATM’s at any time.

For In-Person service, please call one of the numbers below to schedule an appointment.

| Mortgage Lending | (218) 722-5966 |

| Deposit and Consumer Banking | (218) 722-4784 |

| Safe Deposit Box Access | (218) 722-4784 |

| Business Banking and Lending | (218) 733-5569 |

| Trust and Private Banking | (218) 722-4211 |

North Shore Bank offers a wide array of additional banking products and services designed to give you more convenience in managing your finances.

6 Reasons to Sign Up For eStatements

Stop waiting for your monthly statements to come in the mail. eStatements are faster, more convenient, and better for the environment! You get all the same information in an easy-to-read email format and can say good-bye to paper storage and shredding issues.

Debit Card Change

Effective May 14, 2019, debit card transactions you conduct, POS (Point of Sale) and ATM, will be reflected in real time to your balance! Instead of not knowing if your balance includes a debit card transaction at a merchant* or ATM, your balance will have adjusted and you can better manage your account activity. Please contact your branch for more information.

*Excludes merchants who do not process in real time.

North Shore Bank Downtown Renovation!

Exciting things are happening at North Shore Bank for our customers and employees. The Superior Street level of our Downtown Office is undergoing a major renovation to meet the current and future banking needs of our customers. The main lobby will be closed during construction, however we are still open for business at our Downtown location. The Auto Bank at the corner of 2nd Ave West and 1st Street offers both lobby and drive-thru Teller services. The skywalk entrance at 125 W Superior Street is open to access the retail, mortgage, business banking and commercial lending services. All of our branch locations are open normal hours for your convenience. North Shore Bank is committed to this investment in our community and look forward to sharing our newly designed space with you soon!

A New Look And A New Website Address: northshore.bank

Data Breaches - How Can I Protect Myself & My Financial Assets?

The news continues to report on large data breaches which have occurred at different businesses and government entities. The Equifax loss of personal confidential information affected more than 145 million Americans’ information. So if you have taken out any type of loan or make payments on a credit card or other loan, your personal information was most likely stolen!